|

|

|

|

|

|

||

|

|

|

|

|

e-gold

|

| e-gold was an example of an independent monetary system. This is is one of a series of documents about economics and money at abelard.org. | ||

| moneybookers information | e-gold information | fiat money and inflation |

| Transfers using the e-gold system were suspended in 2009 due to legal issues. The web site egold.com is no longer functioning. All links from abelard.org to that site have been removed . |

disclaimer: Caveat emptor (let the buyer beware). |

Index |

|||

| Info | |||

| What is e-gold? | |||

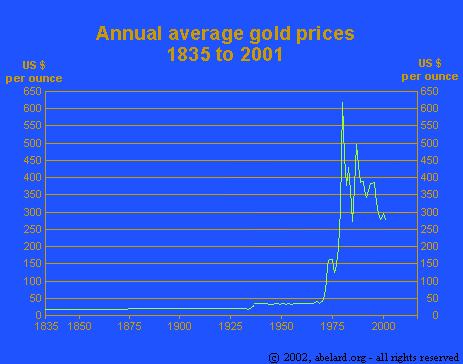

| graph of annual gold prices, 1835

to 2000 inflation (C.P.I.) graph for USA 1914 to 2003 inflation (R.P.I.) graph for UK 1914 to 1997 |

|||

| What can you do with e-gold? | |||

| Why e-gold? | |||

| Credit card downsides | |||

| Administrative stuff | |||

| e-gold works like this… | |||

| How do I set up an e-gold account? | |||

| How much will this cost? | |||

| How do I put some e-gold into my account? (How to buy e-gold) | |||

| When you spend | |||

| A storage (technical name: agio) fee | |||

| How do I turn my e-gold into cash? | |||

| What happens when I use e-gold? | |||

| information on e-gold, including numbers | |||

| exemplar list of ‘independent exchange market-makers’ – a list | |||

| Note about ‘secured instruments’ | |||

| Final words | |||

| End notes |

|||

InfoWhat is e-gold?

|

|||

|

Note: For a

very short period at the beginning of 1980, the gold price peaked at about $850. |

||

While gold is a more stable store of value than paper (fiat) currencies, it still remains a market in which governments have a heavy presence. It is estimated that the world’s central banks still hold about 30,000 tonnes of gold in their vaults. Of recent years, these banks have been dumping some of this gold onto the markets, either regarding gold as a non-performing asset, or attempting to manipulate the market. (Remember this activity is not fully co-ordinated, as the gold is spread around in many banks, who are, to some extent, in competition.) By one measure it has been estimated that, if the banks fully abandoned gold, gold might return to its price at the beginning of the 19th century - estimated at $68 per oz at today’s prices (Economist, 30 May 2002). In the graph above, you will see that the gold price from the early part of the 20th century was about $20 per oz, whereas the curent gold price is over $300 per oz. Thus presently (2002), you receive more than 15 times as many dollars for an ounce of gold. But you will see, from the US Consumer Price Index (C.P.I.) graph below, that the dollar has, in the meantime, been heavily eroded by inflation, until it is now worth no more than a twentieth of its value in the early part of the 20th century. Thus, taking into account the ever-shrinking value of the dollar, the ‘real’ price of gold has hardly changed in a century. Gold has not been exactly a brilliant investment, whatever its merits may be as a currency. There exists a rather strange and esoteric clique known, somewhat disparagingly, as ‘gold bugs’. These enthusiasts, and often sales people, promote the wonders of gold with very great passion, as a royal route to certain wealth beyond avarice. There is no such route, you are advised to approach gold with the same caution a wise person applies to any ‘investment’/gamble. However, a comparison should also be made with the intrinsic value of the pieces of printed paper, or blips in bank accounts, that governments call money. e-gold is a currency system, and serves the same purpose as the money in your purse or bank account. Unlike many other electronic exchange media, e-gold isn’t just fiat government notes turned into bookkeeping blips. Nor is e-gold a paper currency subject to continual government inflation. e-gold is a 100% gold-backed currency. Once you have bought some e-gold, it is available for you to use on the Internet, like electronic money. e-gold can be thought of as a foreign currency that has a value relationship to your usual currency and to other foreign currencies. See here for details of how your gold/e-gold is stored and managed. e-gold is a private digital currency that enables global transactions. e-gold’s internationality is achieved by two actions. Firstly, by not using a national or government-controlled currency (such as US$, Euro or AU$) as the asset to back it, e-gold is independent of government. Secondly, by having points of entry across the world by means of the Internet, any person can purchase with their own local currency some of this international currency. This they can then use to complete international private and business transactions. You will, in fact, be trading using gold as your money instead of a government paper currency. e-gold Ltd will handle your accounting transactions and you will be able to check the current value of your gold holdings equivalent, in other currencies. e-gold isn’t banking, so you won’t be paid interest on the metal

in your account. In fact, you’ll have to pay small transaction and storage

fees. (Opening the account is free and no starting deposit is required.).

However, if you find a bank that handles e-gold as one of its range of currencies

and you use them to hold your e-gold, you can receive interest. [1] (This possibility is still under investigation by www.abelard.org.) |

|||

What could you do with e-gold?

It was a complete monetary system that provides the potential for anyone entering the system to take payments from people across the world, and even construct entire businesses within the system. e-gold that is:

result:

|

| but |

||||

| no, | you do not subsidise merchant bank charges of 3 – 10% on each and every transaction, nor monthly secure transaction and statement charges; | |||

| no, | you do not pay currency conversion charges of around 3% (using a reasonable arrangement, this conversion charge could be ½%). | |||

and, if you had set up your e-gold account from this

site, abelard.org benefited as well! Why e-gold?After extensive researches into different methods of transferring funds from person to person (or person to vendor) using the Internet, we at abelard.org had chosen e-gold and moneybookers as our preferred methods for trading. Our reasons were complex and range widely. Some partial understanding may be gained by examining our documents on emu and inflation. It is probable that, as with most operations,choose other methods. Of the digital gold-based currencies, e-gold was the oldest and the biggest. It had the most account-holders and said it held in gold the equivalent of a small gold mine. Methods using money from a bank account usually require the person transferring the money to use a credit card. |

Credit card payment downsidesFor the payer You have to trust the vendor, who obtains your credit card details, to be honest. You have to trust routing through the Internet to and from that vendor to be secure .To ensure and guarantee that security, the vendor you deal with has to pay for the privilege. It may well also mean you are using the credit card to pay in a different currency to that in your account. The credit card company, or the bank, will charge you handsomely for this ‘benefit’. (Use the calculator provided at [link removed] to see an approximation of how much credit card transactions cost vendors, and so cost you.) For the receiver (e.g. a vendor) From the vendor’s point of view, they are at the mercy of credit cards lacking funds, or being used fraudulently. The vendor has to pay for this by returning payments already received (even months before). This is called charge-back in the trade. And this can happen, even when the goods are not returned. The vendors also incur high overheads in financing and maintaining their ‘merchant status’, which for vendors is the ‘open-sesame’ to the world of credit-card transactions on the net. The high overheads include depositing a capital sum with the merchant bank as security (lazy assets), and paying various monthly charges over and above the transaction charges. A vendor’s overheads will also include increased web-site hosting fees to pay for obtaining Secure Socket Layer (SSL) facilities. SSL capability is necessary to ensure a secure environment for the transfer from payer to receiver, over the Internet, of credit card and other details. Other methods like NOCHEX, are either more limited, or, like PayPal or Billpoint, are even more fraught than credit cards. For details click on the links. Of course, you also always have to remember that transferring value using a credit card is only possible if the recipient is capable of receiving such a value transfer. You cannot give your great-niece, your boy-friend, your yak (currently in another part of the world) any money using your credit card – unless, of course, they are fully set up to take credit card payments as a vendor would be. However, e-gold accountholders are not restricted like this. |

How much did this cost?

|

When you spentNothing for you. The recipient (for instance www.abelard.org)

pays 1% of each transaction, up to US$0.50; that is, we at abelard.org

pay a maximum of 50 US ¢ on a transaction. If someone gives you some e-gold,

then this is what you will pay. |

A storage (technical name: agio) feeof 1% per annum was made by e-gold for the gold that backs your e-gold account.

See [link removed] for details. |

How did I turn my e-gold into cash? (selling e-gold)Two ways: Trading your e-gold Accountholders with more than 400oz gold (equivalent to a small bar of gold bullion and worth about US$120,000) in e-gold may redeem their e-gold as a bar of gold bullion, not just reconvert their e-gold holding to paper currency. (However, this will depend on what types of bullion e-gold Ltd is holding at the time of such a request. They can only redeem gold bullion of the types they are currently holding.) Using an ATM card Card Accounts.TV [link removed], which was previously suggested might be a useful ATM card provider, has announced “a total suspension of business until further notice. [...] we merely are stopping all activities until such time as we can catch our breath and catch up with what we are already swamped with. ” abelard.org will be watching their progress. In the meantime, CardAccounts.TV recommend Euro-lineGold [link removed], who also offer a high degree of confidentiality, see their privacy statement [link removed]. However, they do require a copy of a passport or driving licence. Their ATM card is called a debit card. |

What happens when I used e-gold?When you want to transfer a quantity of e-gold (or e-silver or e-platinum or e-palladium), the transfer is made from your passphrase[1a]-protected account to your recipient’s account. (Your passphrase is stored in the e-gold database in encrypted form so even e-gold Ltd cannot learn it. So it is important that you don’t forget or lose your passphrase!) |

Company |

To buy |

To sell |

GitGold [Due to Google's fears of possible "social engineering", this valid link has been removed. If you are interested in this site, you will need to search for the url yourself. Sorry.] All banking transactions made in US$ |

‘funding fee’ based on amount of money received: from 8% ($40 min.) down to 4.5% (for over $10,000) Payment by: - no cheques. |

“Charges quoted on demand” |

IceGold.com |

4% above e-gold spot rate with international bank wire[see note on secured instruments] |

1% above e-gold spot rate |

Note: IEMMs generally prefer to receive ‘secured instruments’. A secured instrument is a payment document issued

by a financial institution, such as a bank, irrevocably payable against

its own funds (subject only to a finding of forgery. |

disclaimer: Caveat emptor (let the buyer beware). |

| further reading and related documents | ||

| moneybookers information | fiat money and inflation | EMU (European Monetary Union) and inflation – a civil liberty issue |

End notes |

|

| 1 | With a high degree of probability, I would expect this to involve the holding bank lending out your e-gold, very likely on a fractional banking basis. Fractional banking practice tends to trade off reserve ratio against profitability. That is, the lower the reserve ratio, the greater the risk. The greater the risk, the higher the interest that the bank will probably pay you. Thus your decision is a balance betweeen profit and security. Remember the e-gold system is design with a 100% reserve ratio; that is your gold (e-gold) should be immediately available to you under any circumstances. As with any business, it is a matter of trust and reputation that they keep their word/contracts; every time you deal with a business, you have judgements to make cooncerning their competance and their honesty. For more see the mechanics of inflation. |

| 1a | Passphrase: a string of upper and lower-case

characters, numbers, and even special characters, that you concoct to

protect data or access. It is a security key to protect your account and

your transactions. Says e-gold Ltd: A nonsense, virtually random combination of letters

and digits is best. I have found it helpful (to invention and to memorising) to ‘translate’ a random phrase, say ‘web designer’, using a variety of characters, numbers and, sometimes, symbols. A possible ‘translation’ is ‘We8Des1gner’. Another person I know does similar ‘translations’ to mathematical equations. However, if you do invent your passphrase in this manner, make sure your original phrase cannot be connected to you, or to the environment in which the resulting passphrase will be used. |

| 2 | Boxes that appear when your mouse goes over the text or image. |

| 3 | The Discount Rate is calculated as follows: (1-(100/105.5))*100=5.21% |

| 4 | e.g. Western Union |

| 5 | The Discount Rate is calculated as follows: (1-(100/105))*100=4.76% |

| 6 | Endorser: the recipient, who signs (endorses) the money order, usually on its back, for the purpose of cashing it. |

| 7 | A personal cheque is one drawn on a personal bank account, as opposed to a banker’s draft or banker's cheque, which are drawn on the account of the bank concerned, with the funds concerned being reimbursed from the customer’s account. |

| 8 | the current price of gold. |

© abelard, 2002, 4 june the address for this document is https://www.abelard.org/value-transfer//egold-info.htm ~3000 words |